Our Mission

The One Economy Financial Development Corp’s (OEFDC) mission is to create a pathway to financial stability and wealth among low to moderate income individuals and small businesses with an emphasis on the Black community in central Iowa through loans and supporting services.

We work to empower individuals and businesses to create financial stability and wealth by providing training, coaching, and loans. These services are provided in partnership with:

Evelyn K. Davis Center

The Evelyn K. Davis Center for Working Families (EKD) helps families and individuals improve their financial position and connects them with their work and career goals. OEFDC works closely with EKD’s Financial Empowerment Center (FEC) to provide:

Education for Individuals

Small Business Supports

The Directors Council

The Directors Council (TDC) is a coalition of leaders dedicated to improving the conditions of individuals in the Des Moines neighborhoods they serve.

Iowa Community Capital

Iowa Community Capital (ICC) empowers women and communities to create economic opportunities through small business loans, support, and savings services.

Iowa Foundation for Microenterprise and Community Vitality

Iowa Micro Loan is a program created to help Iowans realize their goal of achieving business success when there is a solid idea, team, and commitment to make it work.

Why OEFDC?

As the growth and vitality of Des Moines and Polk County as a whole continue, racial disparities persist with little evidence of the gaps narrowing for Black Polk County. Sometimes people of color in our community have a closer and different perception of our overall economic quality of life.

Consider the contrasts in these statistics when it comes to finances:

22.1% of Black Des Moines residents are unbanked compared to 3% statewide

31.8% of Black Des Moines residents are underbanked compared to 13.5% statewide

Blacks are denied loans at a rate 2.2x higher than the Polk County average (24.15% compared to 10.94%)

How OEFDC and Our Partners Work for Change

We provide personal financial coaching to help people understand the value of their money, protect against financial vultures, predatory lending, and payday lending.

We provide small-dollar loans to help individuals with necessary financial obligations, give them an alternative to predatory lending, and help them establish or build credit.

In collaboration with our partners, we offer an array of services to help Blacks and low-income individuals and entrepreneurs to start new businesses, grow existing businesses, and provide resources for them to be successful, viable businesses for their communities.

Partners

OEFDC is grateful for our community partners and funders:

Lending and Financial Education Partners

Des Moines Metro Credit Union

Evelyn K. Davis Center for Working Families

Financial Empowerment Center

Iowa Community Capital (ICC)

Iowa Foundation for Microenterprise and Community Vitality

Funders

Community Foundation of Greater Des Moines

Northwest Area Foundation

Sammons Financial Group

The Directors Council

Wells Fargo through a grant to ICC

One Economy Financial Development Corp

BOARD OF DIRECTORS

-

VINCE LINTZ, EXECUTIVE DIRECTOR

VINCE LINTZ & ASSOCIATES

-

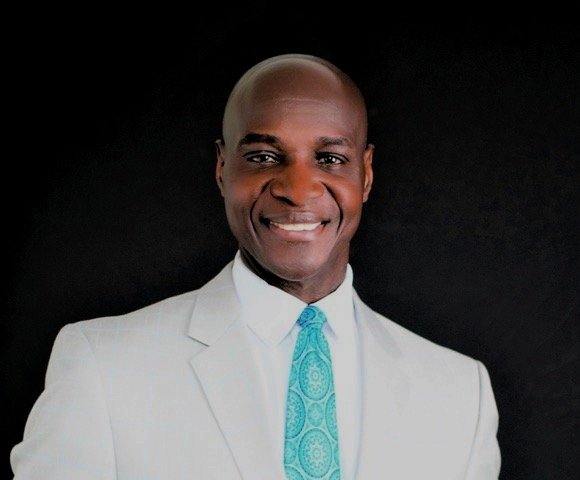

TED WILLIAMS, BOARD CHAIR

THE WILLIAMS GROUP

-

LU SPAINE, BOARD VICE CHAIR

ZUMI COLLECTION, LLC

-

DAVID ATTAWAY, BOARD TREASURER

SAMMONS FINANCIAL GROUP

-

MIKE TRAMONTINA, BOARD SECRETARY

RETIRED

-

JOE BANTZ, BOARD MEMBER

FOSTER GROUP

-

VADA GRANTHAM, BOARD MEMBER

REVELATIONS RESEARCH SOLUTIONS

-

TESSIE JOHNSON, BOARD MEMBER

PWC

-

AMELIA LOBO, BOARD MEMBER

GRINELL COLLEGE

-

COLIN PENNYCOOKE, BOARD MEMBER

PRINCIPAL FINANCIAL GROUP

-

ALEXIS DAVIS

Pyramid Theatre Company

-

MEG SCHNEIDER

Iowa Assocation of Business and Industry

-

Aliou Keita

Lincoln Savings Bank

In Memory Of…

“Never doubt that a small group of thoughtful, committed citizens can change the world; indeed, it’s the only thing that ever has!”

—Margaret Mead

The OEFDC Board is grateful for the time and talents that Terree shared with us. Her desires for the community are evident in the work we do daily.

-

TEREE CALDWELL-JOHNSON

OAKRIDGE NEIGHBORHOOD